tax loss harvesting betterment

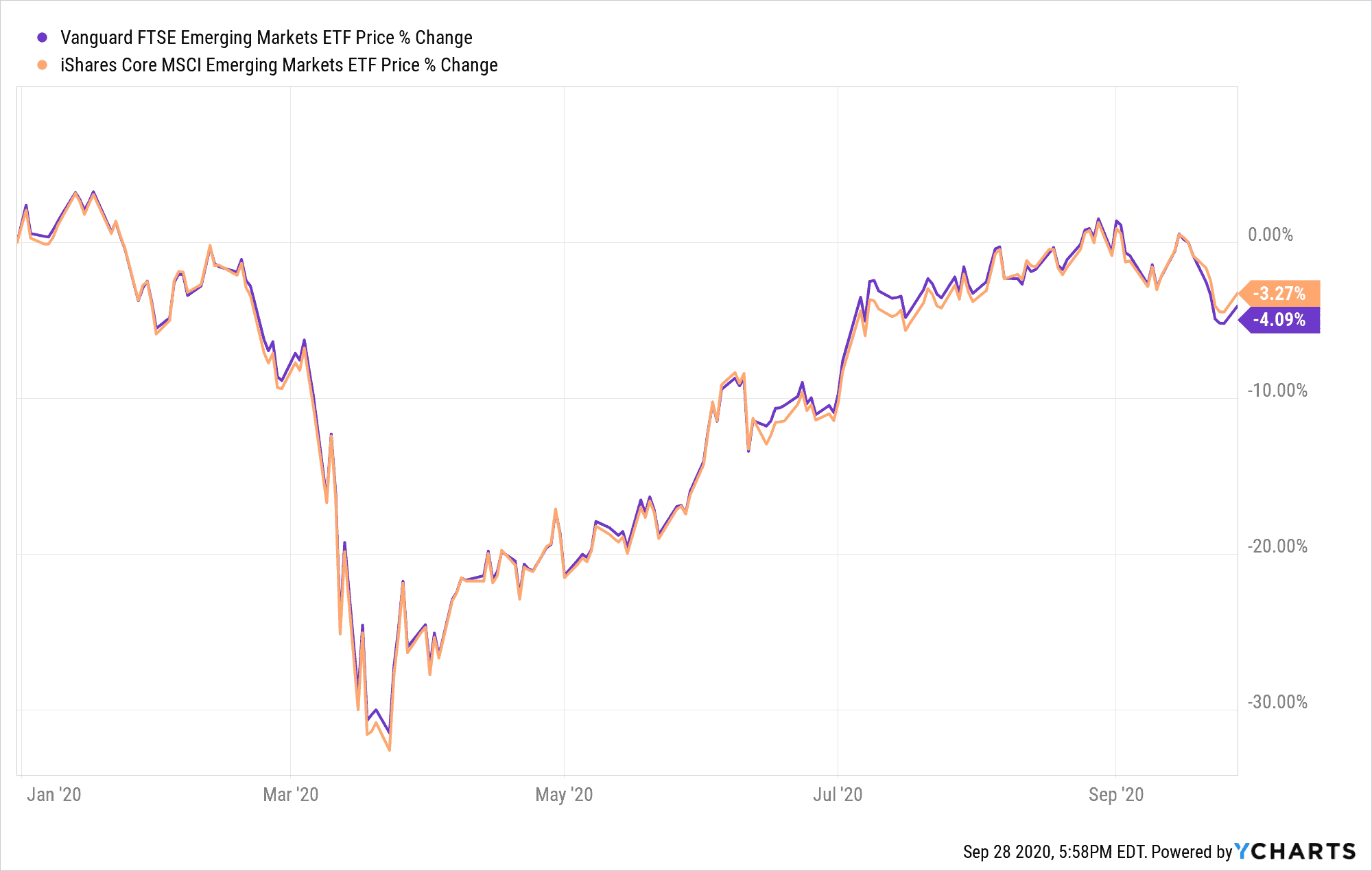

For customers who use our Tax-Loss Harvesting. Wealthfront vs Betterment.

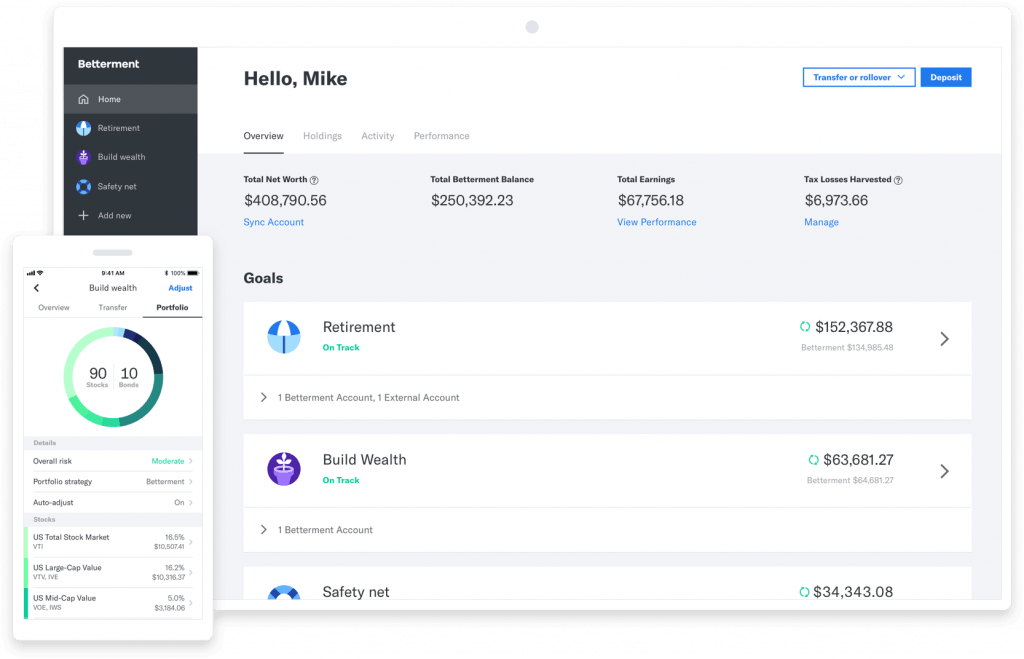

Betterment Investing Review Make Investing Automatic

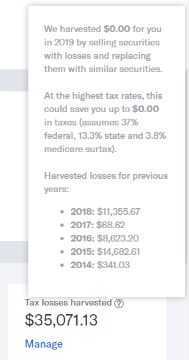

Tax efficiency is a big factor to consider when choosing a Robo-advisor.

. Im looking at a tax bill of roughly 6k. Tax-loss harvesting is a practice used by investors each year to minimize their tax exposure ultimately maximizing after-tax returns Eric Bronnenkant CFP CPA and head. If you make more than a.

We tax loss harvest. Betterment Taxes Summary. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss Harvesting.

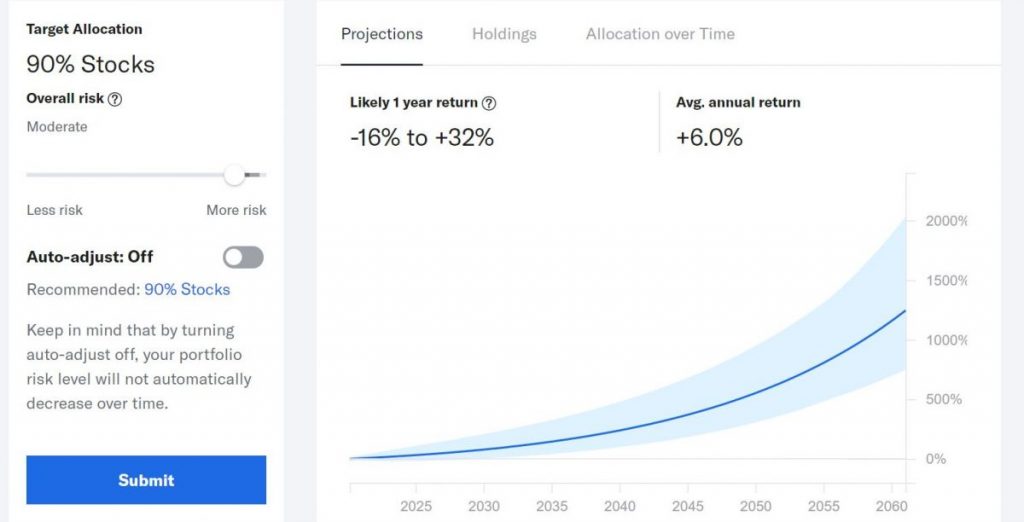

A robo-advisor such as Betterment would handle all of this for you automatically. Betterment Checking made available. Rebalancing helps realign your asset allocation for a balance of.

Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000. Betterment Tax Loss Harvesting Pricing. Harvested losses can be applied to offset both capital gains and up to.

Betterments use of tax-loss harvesting is a huge benefit to efficiently use capital losses to offset your tax liability. Actually Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains. Brokerage services provided to clients of Betterment LLC by Betterment Securities an SEC-registered broker-dealer and member of FINRA SIPC.

Tax Loss harvesting is the practice of selling a security that has experienced a loss. 2 using the capital loss to offset capital gains on other sales. Tax-loss harvesting has been shown to boost after.

How much money does tax loss harvesting save. The Premium option has a 100000. By realizing or harvesting a loss investors are able to offset taxes on both gains and.

Tax loss harvesting is the practice of selling a security that has experienced a lossBy realizing or harvesting a loss investors are able to offset taxes on. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. The Digital level does not require a minimum balance and costs a 025 percent annual fee.

One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio. I want to convert my traditional IRA to a Roth IRA and will have to pay taxes on the gains all the contributions were post-tax. The three steps in the tax-loss harvesting process are.

Betterment increases after-tax returns by a combination of tax-advantaged strategies. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues. However this does not mean you will not owe any taxes.

455 15 votes. A bit of a random question. When investments lose value you can sell them to help offset the taxes that come with income and capital gains.

Betterment and Wealthfront made harvesting losses easier and more. This is the big one. Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be.

The Goals and Benefits of Betterment Tax Loss Harvesting. 1 selling securities that have lost value. Essentially a tax-efficient Robo-advisor will increase.

Youre not in the 10 or 15 tax brackets.

Video Library Visual Stories For Everyday Investors Betterment

Acorns Vs Betterment Robo Advisor Face Off One Shot Finance

Betterment Tax Loss Harvesting Mr Money Mustache

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

What Is Tax Loss Harvesting Forbes Advisor

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Review Portfolio Rebalancing In Its Finest

Betterment Com Review Easy Investing For Busy People

Betterment Review 2022 The Perfect Place To Start Investing

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

:max_bytes(150000):strip_icc()/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

Video Library Visual Stories For Everyday Investors Betterment

Video Library Visual Stories For Everyday Investors Betterment

Betterment Review Pros Cons And Who Should Set Up An Account

Betterment Review 2022 A Robo Advisor Worth Checking Out

![]()

Tax Loss Harvesting Methodology

/betterment_inv-f807c64202ac48a9a5a7dcfe4f2e6205.png)