capital gains tax australia

Capital gains is treated as part of your income tax. If you earn 40000 325 tax.

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

In the example above if you just earned 85000 a year before tax your marginal tax rate is 325.

. Also Capital Gains Tax doesnt apply to depreciated assets used solely for taxable purposes such as business equipment or fittings in a rental property. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. On this page.

Find millions of books from trusted sellers around the world. Including a 10000 capital gain in income would cost 3700. If you own the asset for longer than 12 months you will pay 50 of the capital gain.

In Australia when investors sell shares and other listed securities for a price higher than they paid the profit or capital gain may be subject to a capital gains tax CGT. Your total current year capital gains or losses are more than 10000. You must complete the CGT schedule if.

Check if you are eligible for the 50 CGT discount as a foreign resident. However youll receive a 50 discount on. If your business sells an asset such as property you usually make a capital gain or loss.

When you sell this asset after holding it for more than a year youll be taxed at the long-term capital gains rate of 15. But when you add the 100000 of taxable capital gains from the asset sale. This includes if you received a distribution from a trust including a managed.

Check if your assets are subject to CGT exempt or pre-date CGT. If you have a capital asset that you sell youll be left paying the full rate of capital gains tax if you sell it within 12 months of purchase. Contact a Fidelity Advisor.

CGT discount for foreign residents. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. However once the general 50 discount is deducted the taxpayer.

Capital gains are taxed at the same rate as taxable income ie. Ad Buy books anywhere anytime. Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250.

As a foreign resident find out which of your. If youre in the top tax bracket and sell a property like this youll be. If you do not pay income tax in Australia.

This is the difference between what it cost you and what you get when you. Youd then add this 261000 of capital gain to your assessable income for the tax. You must then work out five-tenths of the capital gains tax which is 28125.

Australias CGT as originally enacted to commence in the 1985-86 fiscal year promoted tax system integrity by taxing capital gains at the same rate as the ordinary income of individuals. The tax on the capital gain would be 37. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Contact a Fidelity Advisor. Your capital gain would therefore be 500000 minus 239000 which is 261000.

If you sell a house in Australia add the capital gain to your tax return for that financial year.

Why Capital Gains Tax Rates Should Be Lower Than Those On Labor Income American Enterprise Institute Aei

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

Capital Gains Tax Analytics Australia Facebook

What Is Capital Gains Tax Cgt Rask Education

Do I Pay Crypto Tax In Australia 2022

12 Ways To Beat Capital Gains Tax In The Age Of Trump

What Is The Capital Gains Tax The Motley Fool

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LQUMLBJ7ZFHVNNYWCP3CXRRFWI.jpg)

Australian Tax Office Warns Crypto Investors On Capital Gains Obligations

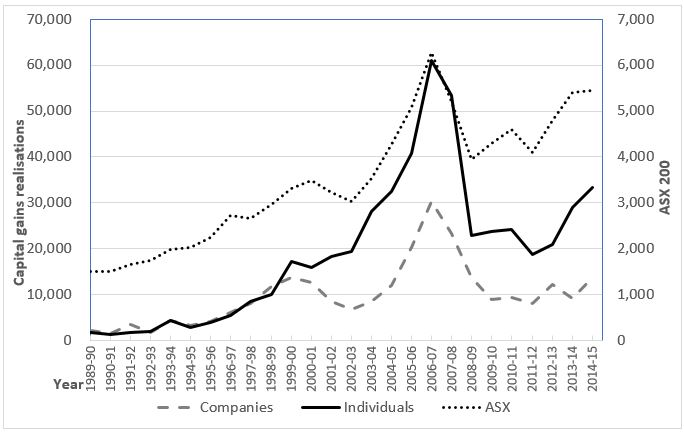

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog

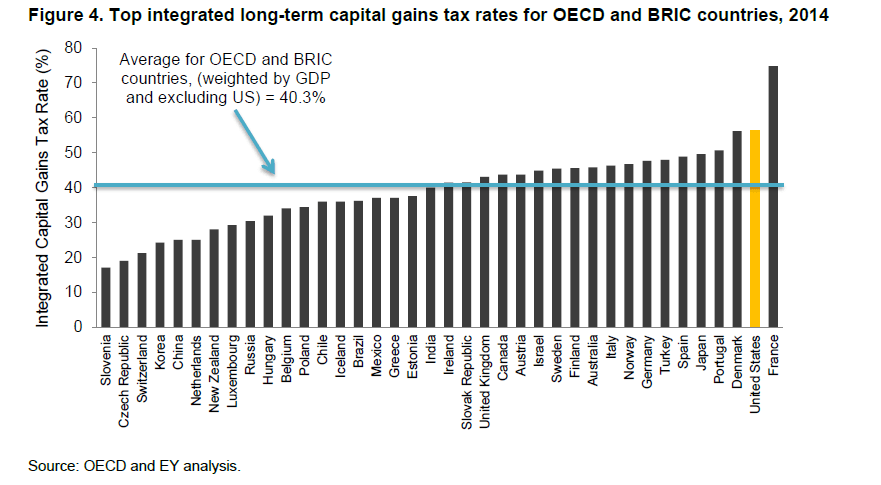

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

Crypto Tax In Australia The Definitive 2022 Guide

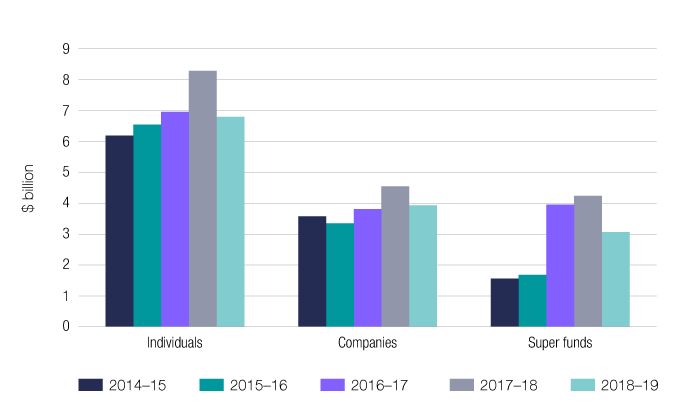

Capital Gains Tax Statistics Australian Taxation Office

Rsu Taxes Explained 4 Tax Strategies For 2022